Centralized Stablecoins Dominate DeFi

Why that's a problem for censorship-resistant crypto

Stablecoins are cryptocurrencies designed to maintain a stable value. Most are pegged to the US Dollar. I wrote about the many types of stablecoins here. Sadly, the vast majority are centralized.

Why is that a problem? 🤔

Market Breakdown

First, let’s examine the stablecoin market today (May 2025).

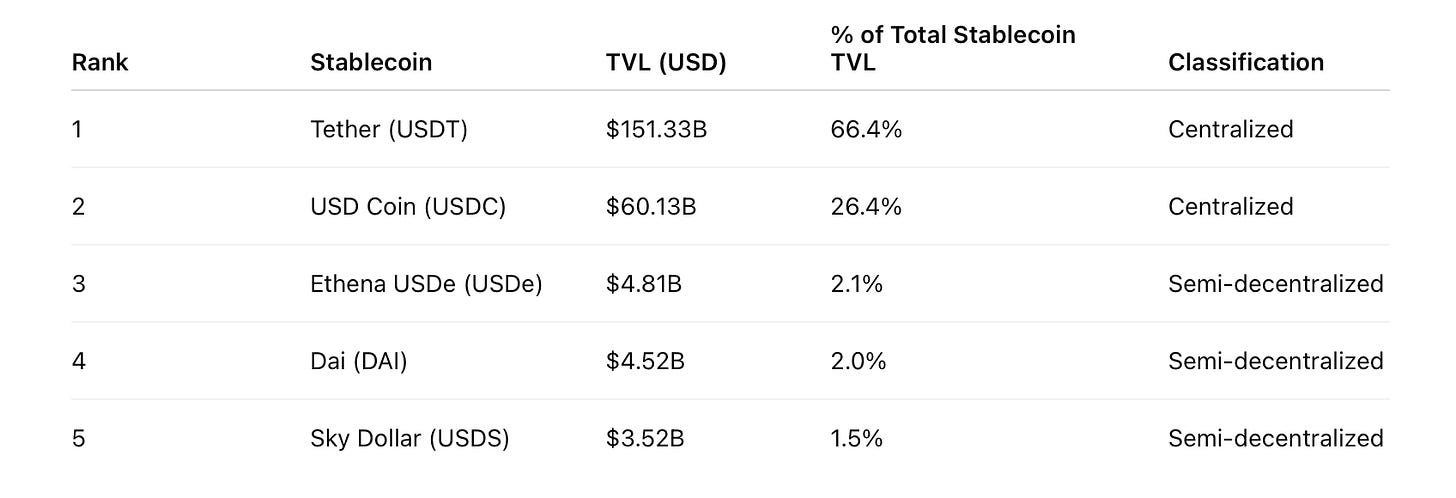

Here is a table of the top 5 stablecoins by total value locked (TVL), including market share and classification of their current level of decentralization:

A centralized stablecoin is issued and controlled by a single company or entity. It is typically backed 1:1 by fiat reserves (e.g. US Dollars) or liquid assets. The issuer can freeze accounts, blacklist addresses, or adjust supply. Tether (USDT) and Circle (USDC) dominate, controlling over 90% of the entire stablecoin market.

A semi-decentralized stablecoin is governed by a decentralized protocol (e.g. a DAO) but typically relies on centralized collateral (like USDC) or off-chain infrastructure. Control is shared but not fully trustless. A company or government cannot block or confiscate a semi-decentralized stablecoin, but can attack the underlying collateral. This is not easily done, however.

A decentralized stablecoin is fully governed by smart contracts and/or DAOs, with no reliance on fiat, banks, or centralized actors. Collateral is entirely decentralized and onchain (e.g. ETH), and no single entity can control the system. This is the holy grail for crypto users aligned with cypherpunk values (privacy, freedom, self-sovereignty, censorship-resistant).

The top two stablecoins are centralized, representing over 90% of the entire stablecoin market cap. When you classify all existing stablecoins by their level of decentralization, it’s clear that centralized stablecoins dominate:

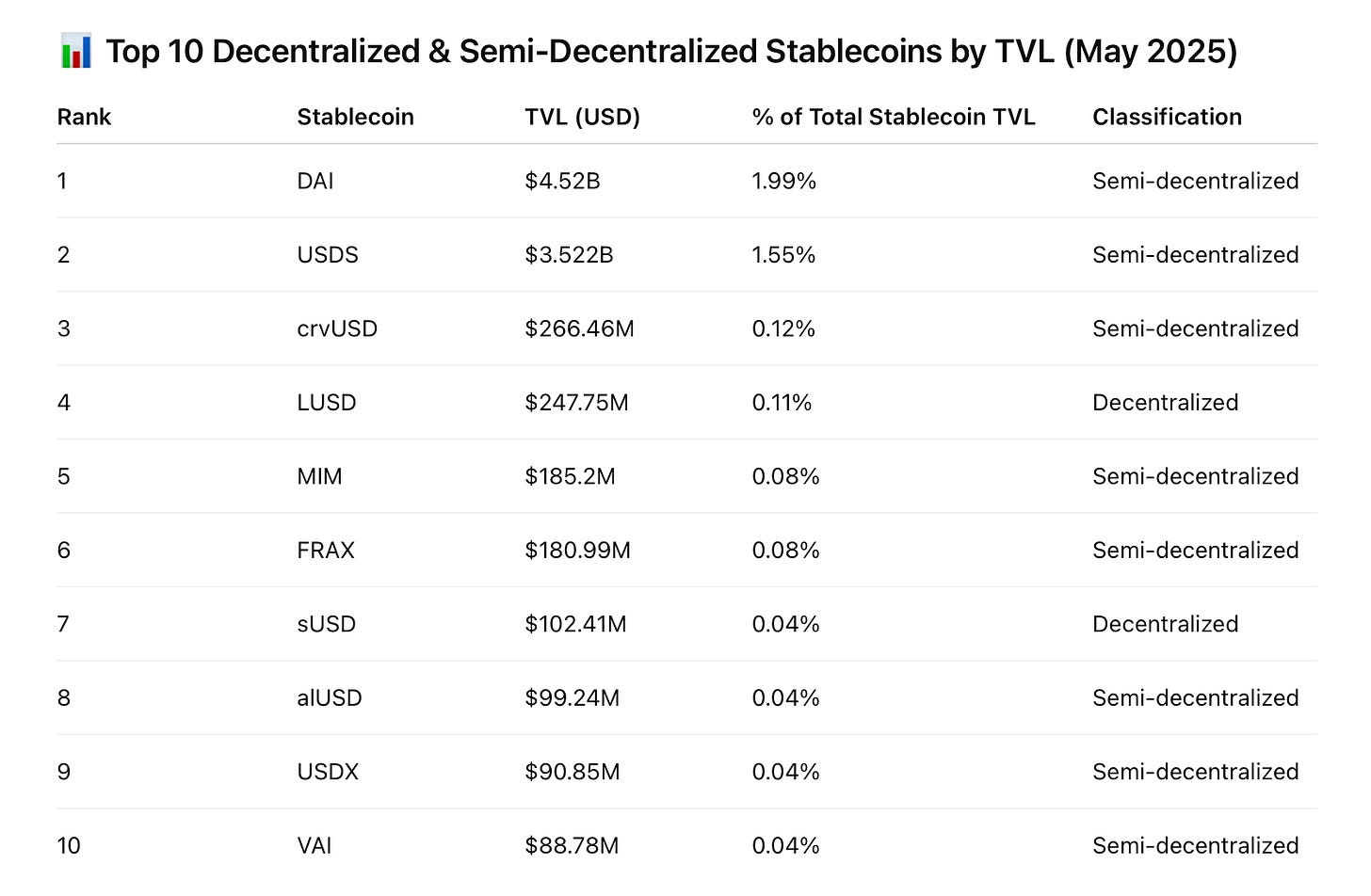

Decentralized stablecoins make up approximately 0.04% of the current market, more or less a rounding error. 😢 Decentralized and semi-decentralized stablecoins combined make up less than 4% of the total market.

Worse, the dominance of centralized stablecoins will likely increase as more institutions embrace crypto. What does this mean for users?

The Problem with Centralized Stablecoins

At its core, crypto is about building a more equitable, inclusive financial system outside the control of centralized entities like governments and large corporations.

Unfortunately, centralized stablecoins are replicating traditional finance on blockchains with all their inherent problems, making crypto more fragile. Major issues include:

Centralization of Control. Centralized stablecoins like USDC and USDT are issued and controlled by centralized companies, easily influenced by governments (similar to banks). Issuers can freeze, blacklist, or confiscate funds at their discretion, often in response to government requests. Banks and other traditional financial institutions typically hold the collateral reserves backing centralized stablecoins. This reintroduces the same trust assumptions crypto was meant to solve.

Regulatory Leverage. Governments can pressure or regulate these issuers, indirectly controlling onchain assets or activity. Both Tether and Circle have blacklisted addresses holding their stablecoins. This sets a precedent for censorship. You can only use their stablecoins with permission, much like money in a bank today.

Lack of Transparency. Collateral backing centralized stablecoin is often opaque. Audits can take time and can be manipulated. Again, we are back to trusting centralized entities and rating agencies to represent their financial health accurately.

With decentralized and semi-decentralized stablecoins, collateral is onchain and fully transparent. You do not have to trust a 3rd party, you can check the chain yourself!

Decentralized and semi-decentralized stablecoins cannot be frozen, and governments have limited or no leverage over decentralized entities (DAOs) that control them.

Why Censorship Resistance Matters

Decentralized and semi-decentralized stablecoins offer meaningful advantages over centralized options, especially for users who value censorship-resistance and trust minimization.

Why is it essential to have a censorship-resistant stablecoin?

‼️ Governments cannot seize decentralized or semi-decentralized stablecoins without your consent.What does that mean in practice? I wrote about the Nelson family here:

In April 2020, the FBI informed Carl Nelson, Amy's husband and a former real estate transaction manager for Amazon, that he was under investigation for allegedly favoring certain developers in exchange for kickbacks.

Despite no criminal charges being filed against him, the federal government, working closely with Amazon, seized approximately $892,000 from the Nelsons' bank accounts!

The Nelson family had their financial assets frozen by the US government without being convicted of any crime! They had to fight Amazon.com in court without access to their bank accounts. They eventually won their court case, but it ruined them financially.

💡 The government could NOT have seized the Nelson family assets if held onchain with a decentralized or semi-decentralized stablecoin. On the other hand, if the Nelson family had their dollars onchain using a centralized stablecoin, the US government could have frozen those assets. The government would have simply petitioned the issuer of the stablecoin, e.g. Circle (USDC) or Tether (USDT), to blacklist the onchain accounts linked to the Nelson family.

Censorship-resistant Stablecoins

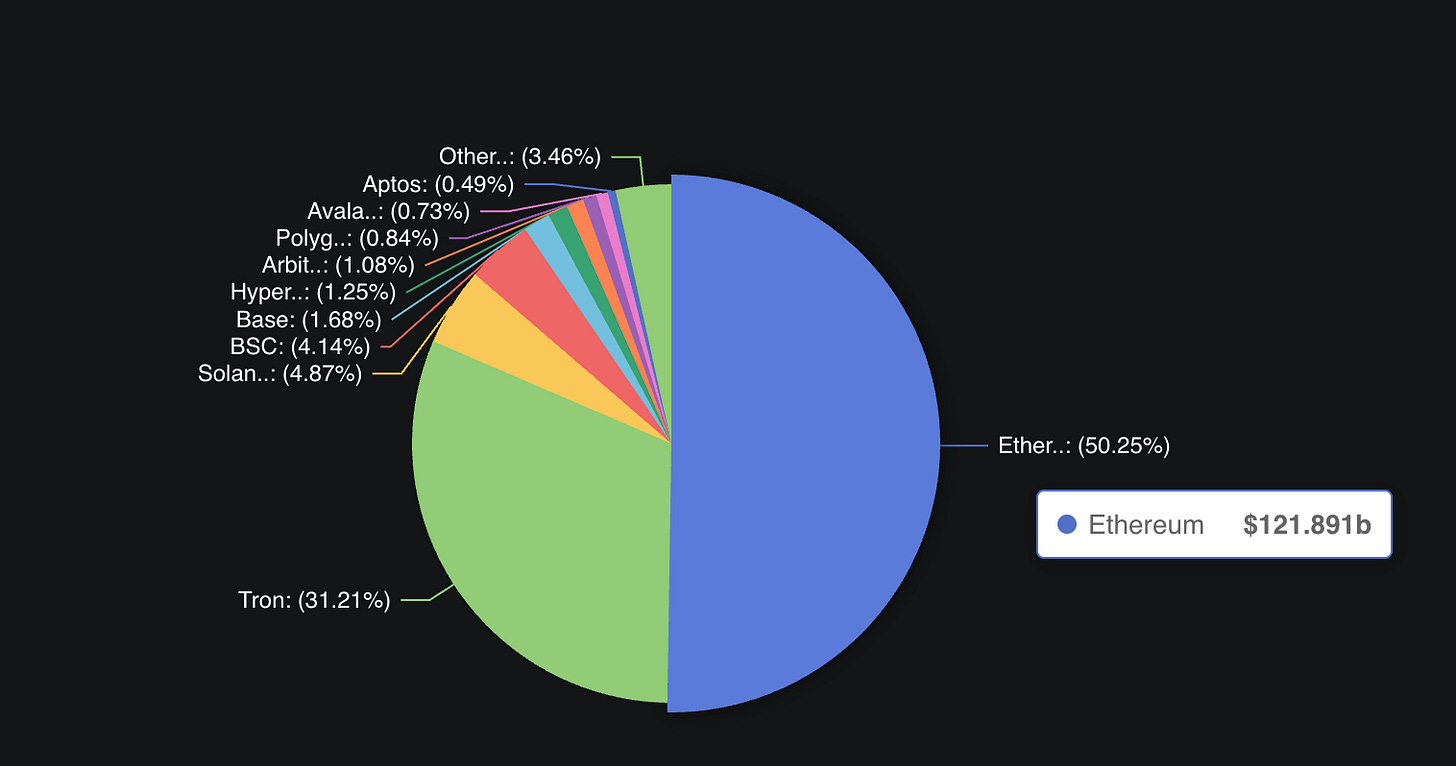

Almost all censorship-resistant stablecoins are on the Ethereum blockchain. Over half of all existing stablecoins are on Ethereum:

Tron, the second largest chain for stablecoins, is highly centralized. It’s grown because of its extremely low transaction costs, making it popular in developing regions. But the entire chain is controlled by a minimal number of validators under the Tron Foundation, managed by one person: Justin Sun. Any crypto asset on Tron should be considered centralized and at risk.

🚨 If you value censorship-resistance, use stablecoins on the Ethereum blockchain.So Ethereum should be your preferred blockchain. But which stablecoins are right for you?

The market cap of decentralized and semi-decentralized stablecoins is relatively low, but users have many interesting options.

DAI (USDS)

More or less the OG of DeFi stablecoins. DAI is a semi-decentralized stablecoin created by the MakerDAO protocol, designed to maintain a soft peg to the U.S. Dollar through overcollateralization with crypto assets like ETH and centralized assets like USDC. DAI’s reliance on USDC and other centralized crypto assets is why it’s considered semi-decentralized and not fully decentralized.

Unlike centralized stablecoins, DAI is governed by a decentralized autonomous organization (DAO), where MKR token holders vote on risk parameters, collateral types, and system upgrades.

In early 2024, the MakerDAO community began a major transformation known as the Endgame Plan, part of which involved the rebranding of DAI to USDS (Sky Money).

LUSD

My favorite decentralized stablecoin! Liquity USD (LUSD) is a decentralized, USD-pegged stablecoin issued by the Liquity Protocol on Ethereum.

LUSD is fully backed by ETH and offers interest-free borrowing with a minimum collateral ratio of 110%. LUSD can be redeemed at face value for ETH at any time, ensuring a price floor and maintaining its peg.

The protocol is non-custodial, immutable, and governance-free, meaning its rules cannot be changed without a hard fork. Users can open a "Trove" by depositing ETH as collateral and borrowing LUSD. The system includes a Stability Pool, where LUSD holders can deposit their tokens to earn rewards and help maintain system stability during liquidations.

crvUSD

crvUSD is Curve Finance’s native stablecoin, launched in May 2023. Curve is a major player in stablecoins.

I would classify crvUSD as semi-decentralized, as much of the collateral backing it is centralized. For example, wBTC is a wrapped (synthetic) version of BTC on Ethereum, maintained by a centralized entity (see below). Most of crvUSD is minted using wBTC.

What sets crvUSD apart is its innovative Lending-Liquidating AMM Algorithm (LLAMMA), which enables soft, continuous liquidations. Instead of triggering full liquidations when collateral value drops, LLAMMA gradually rebalances the collateral into crvUSD, reducing the risk of sudden losses for borrowers and minimizing bad debt for the protocol.

Governments could not censor crvUSD directly, but could potentially go after the centralized, onchain assets used as collateral to mint crvUSD. This is not easy, however, and would cause significant disruptions across all of DeFi.

Others

There are many other decentralized or semi-decentralized stablecoins. A partial list can be found here:

Conclusion

Stablecoins are fast becoming crypto’s killer use case, with exponential growth. The most popular stablecoins are USDT and USDC, which are highly centralized. As more institutions embrace crypto, the dominance of centralized stablecoins will likely increase.

Centralized stablecoins offer convenience, greater liquidity, and more integrations within DeFi protocols. But users are at the mercy of the stablecoin issuer. Like holding cash in a bank, third parties can freeze or seize centralized stablecoins.

Using decentralized or semi-decentralized stablecoins can dramatically increase the freedom and control you have over your assets onchain. Solid options include LUSD, USDS, and crvUSD. There are many others. Ethereum is the only chain at scale for decentralized and semi-decentralized stablecoins.

All stablecoins are not equal! Understand the benefits and risks when choosing a stablecoin to avoid unpleasant surprises.