An Overview of Stablecoins

Why they have quietly become crypto's killer use case

In this article, we’ll examine:

The growth of stablecoins

Benefits and use cases

Types of stablecoins

Why Ethereum dominates

Exponential Growth

A stablecoin is a cryptocurrency designed to maintain a stable value by pegging its price to an external reference, such as a fiat currency (like the US Dollar), a commodity (such as gold), or a basket of assets. The main goal of stablecoins is to reduce the price volatility commonly seen in other cryptocurrencies, making them ideal for everyday transactions.

While stablecoins have existed since 2014, they did not gain popularity until MakerDAO launched DAI, the first stablecoin on the Ethereum blockchain, in 2017. Stablecoin usage took off in 2020 with the rise of DeFi (decentralized finance), allowing investors to trade and book profits in USD. Stablecoin growth has accelerated over the past 18 months, becoming the primary onchain transactional currency.

‼️ Bitcoin is not used in any substantial way as a transactional currency. Stablecoins, mainly on Ethereum, dominate this segment.Crypto detractors like Nicholas Taleb have noticed, calling Bitcoin a “technological tulip.” And while this is true for Bitcoin, it’s not true for stablecoins.

Unlike Bitcoin, stablecoins do not sit idle in crypto wallets. In 2024, total stablecoin transfer volume reached $27.6 trillion, surpassing the combined payment volume of Visa and Mastercard by almost 8%!

Today, the total market cap of stablecoins is $238 billion, an increase of 83% from January 2024. To put that into perspective, dollar-denominated stablecoins now represent 1% of the M2 money supply.

Tether (USDT) and Circle (USDC), the largest stablecoin issuers, collectively hold over $204 billion in U.S. Treasuries, making them the 14th-largest holder globally. Together, they hold more US Treasuries than entire nations, including Norway and Brazil.

With an improving regulatory environment, growth forecasts remain extremely bullish. According to David Pakman of CoinFund, the total stablecoin market cap could grow to $1 trillion by the end of 2025. Citibank believes stablecoin supply will hit almost $4 trillion by 2030.

Stablecoin issuers could soon surpass offshore banks to become major players in the $13 trillion Eurodollar market.

Benefits and Use Cases

Corporations use stablecoins to save time, reduce costs, and improve settlement efficiency. I wrote about my own experience incorporating stablecoins into my consulting business here.

Stripe began supporting USDC payouts in 2023 and strengthened this initiative with its $1.1 billion acquisition of Bridge in 2024.

Revolut uses USDC and USDT to help businesses pay international suppliers without incurring traditional foreign exchange fees of 1-3%. This translates to $10,000–$30,000 savings on a $1 million transaction.

Remittance providers like MoneyGram are also adopting stablecoins to avoid high banking costs and slow processing times. This is especially critical in regions where transfer fees remain prohibitively high: Southeast Asia, Africa, and Latin America.

Users love stablecoins for their convenience. They are a natural extension of fiat, a user-friendly way to transact onchain. What makes more sense: paying for a cup of coffee with BTC, or using a dollar stablecoin like USDC?

Stablecoin Classification

There are four primary types of stablecoins:

1. Fiat-Backed Stablecoins

Fiat-backed stablecoins are by far the most common. They are pegged to traditional currencies like the U.S. Dollar or Euro and backed by cash and/or cash-equivalent reserves.

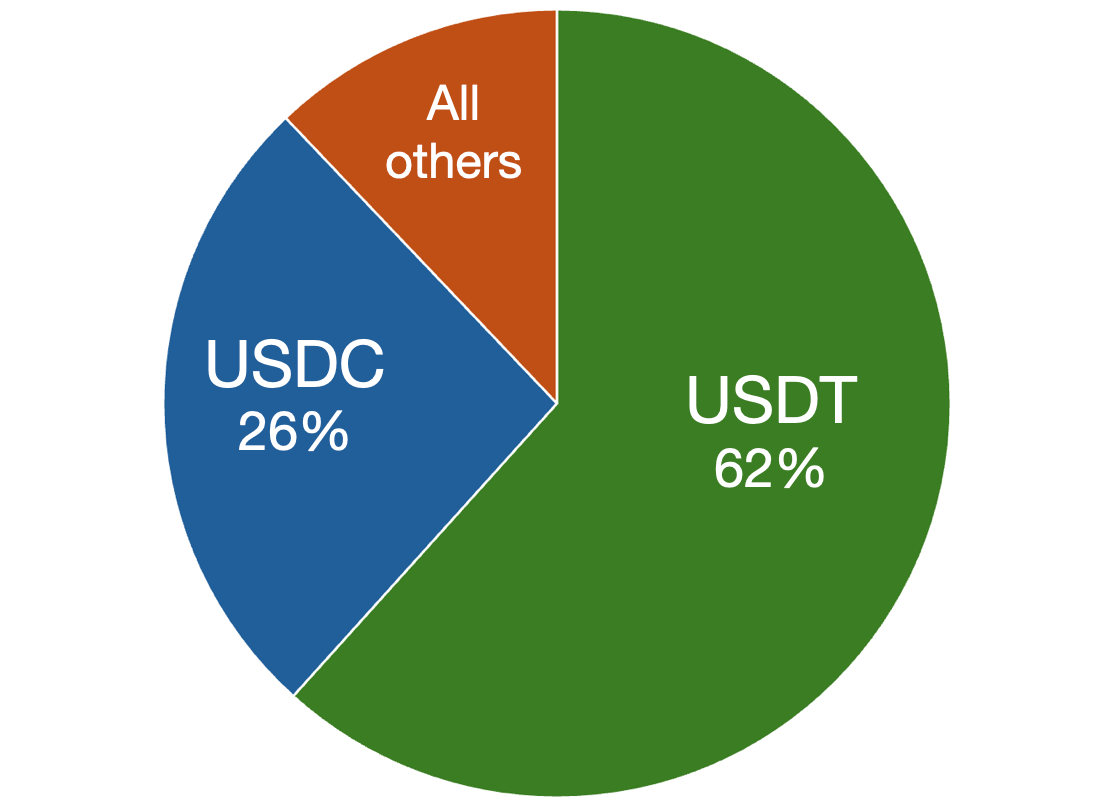

Examples include USDT (Tether) and USDC (Circle), which account for 88% of the entire $238 billion stablecoin market today.

Fiat-backed stablecoins are relatively straightforward: you exchange your fiat dollars or Euros for crypto equivalents. They are especially interesting for businesses, offering them a fast, low-cost way to move money across borders.

The major downside of fiat-backed stablecoins is that they are highly centralized. Users must trust issuers like Tether and Circle to remain solvent and redeem their stablecoins for fiat. Those same issuers can blacklist wallets, preventing you from transacting with your stablecoins.

2. RWA Stablecoins

RWA stablecoins are backed by real-world assets (RWA) such as gold, commodities, or financial instruments like U.S. Treasuries.

💡 Fiat-backed stablecoins are a subset of RWA stablecoins, but because of their large market share, we tend to break them out into their own, separate category.BUIDL, BlackRock’s first tokenized fund issued on a public blockchain, is a popular example of an RWA stablecoin. The fund provides exposure to US dollar yields by holding highly liquid, short-term assets and distributing dividends on-chain.

Paxos Gold is another example. Each PAXG token is backed by exactly one fine troy ounce of physical gold (London Good Delivery standard). It’s regulated by the New York State Department of Financial Services (NYDFS).

3. Crypto-Backed Stablecoins

Crypto-backed stablecoins are also called overcollateralized stablecoins because users must lock capital to “mint” these assets.

Because these stablecoins typically use volatile assets as collateral (ETH, BTC, etc.), they must be over-collateralized to maintain a 1:1 peg. The process of minting crypto-backed stablecoins resembles the following:

Liquidations help crypto-backed stablecoins keep their peg. If the value of the collateralized asset used to mint the stablecoin falls below a predetermined threshold, the user is liquidated. All or part of their collateral is sold to cover the debt (plus penalties).

Crypto-backed stablecoins like DAI (now USDS), LUSD, crvUSD, and GHO are more decentralized than fiat-backed stablecoins. Their collateral is fully transparent onchain.

Because they are over-collateralized, crypto-backed stablecoins do not scale easily. They often require regular maintenance, so user engagement is key. If you mint a crypto-backed stablecoin, you must closely monitor the health of your collateralized assets to avoid liquidation.

However, you don’t need to mint a crypto-backed stablecoin to use it. You can swap other assets for these tokens and buy them on the secondary market. In that case, you no longer carry liquidation risk. However, you still carry depeg risk for the stablecoin, should the system become unstable.

4. Algorithmic Stablecoins

These stablecoins use automated mechanisms to manage supply and demand to maintain a stable value, without being overcollateralized or backed by physical assets.

While interesting, they have proven risky. The collapse of Terra (UST) in 2022 was a high-profile example. Algorithmic stablecoins were an attempt to avoid the downside of overcollateralization.

🚨 Algorithmic stablecoins are inherently fragile and have a poor track record, especially during stress scenarios. Many have failed or collapsed due to death spirals or insufficient demand.FRAX was an example of an algorithmic stablecoin, but they have moved to more RWA backing. Ampleforth (AMPL) is another example. Ampleforth aims for a price of $1 (in 2019 USD), adjusted for inflation. AMPL has been very volatile. It has frequently traded well above or below its peg, especially in bull or bear markets.

Ethereum: Stablecoin Market Leader

Ethereum is the market leader for stablecoins with over 50% market share:

Ethereum is the most decentralized smart contract blockchain, making it attractive for businesses. It's also the primary home of DeFi, a major market for stablecoins, and the place where most experimentation takes place. Few decentralized stablecoins exist outside of Ethereum.

Tron, the second-largest blockchain for stablecoins, is highly centralized, allowing it to process transactions quickly and at a fraction of the cost compared to Ethereum. The downside is that you lose the primary advantage of blockchains: decentralization, which ensures credible neutrality and censorship resistance.

Bitcoin’s base layer does not natively support smart contracts or token standards that allow for the direct issuance of stablecoins. However, stablecoins have been implemented on Bitcoin through advanced layers and sidechains that extend its functionality. These secondary layers are more centralized and remain unproven, which is why Bitcoin remains a niche player for stablecoins.