The Case for Self-Custody

Stablecoins matter when banks and governments fail

Crypto has many legitimate criticisms: it’s overly speculative, filled with scams, has a poor user experience, mistakes can be extremely costly, etc. All true!

However, I’m always baffled when someone claims crypto has no utility. Jamie Dimon, CEO of JPMorgan, for example:

"I've always been deeply opposed to crypto, bitcoin, etc... The only true use case for it is criminals, drug traffickers, money launderers, [and] tax avoidance... If I was the government, I'd close it down."

I use crypto almost every day. I’m not a drug trafficker or money launderer, and I pay my taxes. 😊 Crypto adds real value to my life:

I manage my consulting business with crypto: invoice clients, pay suppliers, and more

I earn interest on my Dollar and Euro deposits using decentralized applications like Aave

My primary debit card is linked to a Euro crypto account

I make international money transfers in seconds for pennies

I pay my corporate taxes with crypto (sadly, the IRS does not yet support crypto)

And perhaps most importantly,

Thanks to cryptography, I have complete control of my onchain assets

I don’t need a bank’s approval to open an account, earn interest, or move funds. A rogue government cannot seize my assets. None of that would be possible without self-custody, arguably crypto’s greatest utility.

‼️ Self-custody is the foundation for all crypto use cases.Corporate & Government Overreach

We rely on financial institutions to hold our savings and investments, assuming we have ownership and legal protections. But in emergencies, when you give up control of your assets, you are ultimately at the mercy of the state to “do the right thing.” That is not always the case.

🇨🇾 Cyprus and the Bank Bail-In

In 2013, Cyprus's banking sector was heavily exposed to Greek government bonds. When Greece defaulted on its debt, Cypriot banks suffered massive losses, and many became insolvent overnight. Bank investors gambled and lost.

Unfortunately, instead of bank shareholders or international lenders covering those losses, the government devised an innovative alternative: using customer deposits to save the country’s failing financial system. This became known as the Cyprus bank bail-in, the first of its kind in the EU.

If you had more than €100,000 in a Cypriot bank, the government seized a significant portion of your deposits. In some cases, account holders lost everything above the insured threshold, with no warning and no legal recourse.

🇱🇧 Lebanon’s Dollar Ponzi

Lebanon ran a Ponzi-like financial system for years. Banks offered high interest rates to attract foreign currency deposits, mainly US Dollars. These deposits financed government deficits and kept the Lebanese pound (LBP) closely pegged to the US Dollar.

It worked so long as fresh foreign capital flowed into the country. However, in 2019, massive public debt and government incompetence caused everything to crash. The LBP lost 98% of its value against the Dollar.

Lebanon imposed capital controls to compensate for shortfalls, froze bank accounts, and forcibly exchanged bank deposits from USD to LBP at highly unfavorable rates (not market rates). As a result, the life savings of many Lebanese were wiped out overnight.

🇺🇸 Civil Asset Forfeiture

In the USA, law enforcement agencies use civil asset forfeiture to seize billions of dollars in assets each year from people merely suspected of a crime.

Much of that money goes back to law enforcement agencies, increasing their budgets. Incentives are perverse.

The Nelson family is a typical case of government agencies conspiring with a large corporation — in this case, Amazon — to weaponize civil asset forfeiture.

In April 2020, the FBI informed Carl Nelson, Amy's husband and a former real estate transaction manager for Amazon, that he was under investigation for allegedly favoring certain developers in exchange for kickbacks.

Despite no criminal charges being filed against him, the federal government, working closely with Amazon, seized approximately $892,000 from the Nelsons' bank accounts!

The Nelsons eventually prevailed in court after a long and costly battle. But it was a pyrrhic victory. As Amy noted:

Amazon still won. They destroyed my family. We lost our home, careers & reputations. The DOJ still holds onto hundreds of thousands of dollars seized from my husband & his businesses.

Stablecoins, not Bitcoin

Crypto was in its infancy in 2013, just as Cyprus banks were imploding. Bitcoin launched in 2009, Ethereum in 2015. Depositors were entirely at the mercy of the banks and the state.

When the Lebanese Pound crashed six years later, crypto was already a viable option. However, most depositors, then and now, are reluctant to hold BTC as a replacement for bank deposits. They want Dollars or Euros. They want asset protection without volatility.

Stablecoins are the ideal solution. You can hold Dollar or Euro stablecoins safely on Ethereum. To earn interest, you can move those assets into decentralized applications like Aave or Morpho. You retain complete control over your money, even when deployed into onchain applications to earn yield.

The US government could not have seized that money if the Nelson family kept at least part of their savings in stablecoins. With crypto self-custody, the legal burden shifts to the government, preventing civil asset forfeiture without due process. While this plays out, you will have access to your stablecoins. You can pay bills, fund your legal defense.

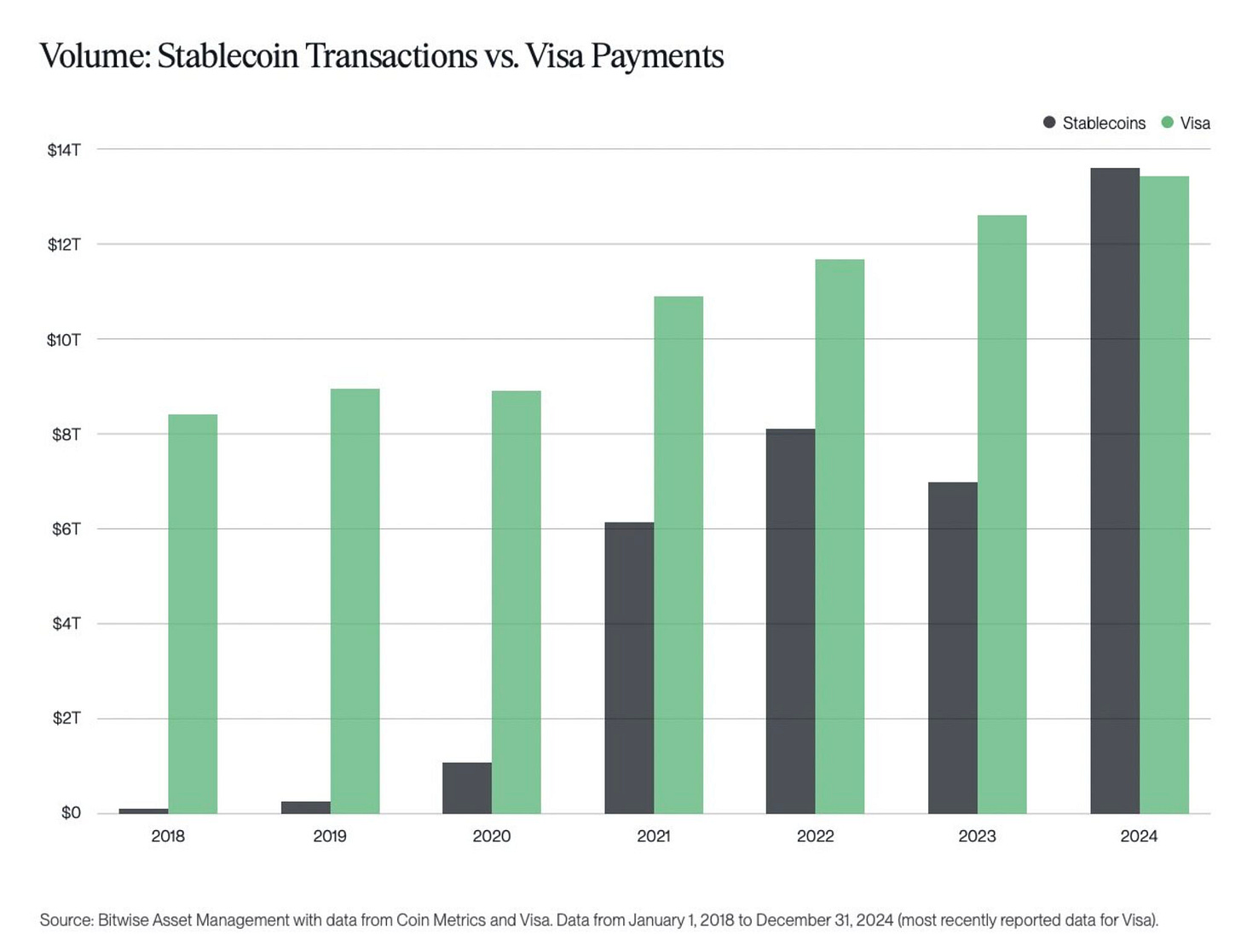

Stablecoins are no longer niche solutions. They are viable alternatives to holding Dollars or Euros in a traditional bank. As of April 2025, their total market cap was over $230 billion. Stablecoins are often used in global financial transactions. In 2024, total stablecoin transaction volume surpassed Visa and Mastercard payment volume.

How to Self-Custody Crypto

Buying ETH or stablecoins like USDC or USDT and keeping them on an exchange like Coinbase is not self-custody. Coinbase controls your assets. You have replaced one centralized entity — your bank — with another.

Worse, crypto exchanges like Coinbase, Kraken, or Binance often exist in a legal gray area. Many reside in offshore jurisdictions that offer little legal recourse for loss of funds. Traditional banks typically provide some form of depositor insurance.

🚨 Crypto exchanges give users the illusion of greater safety when holding cryptocurrencies, but the opposite is often true.However, until you learn how to manage your assets onchain safely and securely, I would still recommend reputable, centralized services like Coinbase to secure your crypto. Education is key!

Self-custody Options

There are two excellent ways to self-custody funds onchain, and I use them both:

A hardware wallet like Trezor, coupled with a browser wallet like Rabby. Metamask is another browser-based wallet option, but Rabby is much more user-friendly, especially for beginners.

A multi-sig smart account using a proven solution like Safe. Safe secures over $100 billion in crypto assets on Ethereum and EVM (Ethereum Virtual Machine) blockchains.

1. Hardware Wallets

Hardware wallets, when used correctly, are extremely safe. However, you must, at a minimum:

Buy the hardware wallet from a trusted source, ideally the original manufacturer

Protect your seed phrase

Use a PIN code

Understand how hardware wallets work to avoid social engineering scams

Have extremely good opsec (operational security practices)

This can all be quite intimidating to new users. Mistakes are costly!

It’s better to start slowly with self-custody. Only move a small percentage of your crypto to your hardware wallet. Over time, you can increase the amounts as you gain more confidence.

2. Safe Smart Accounts

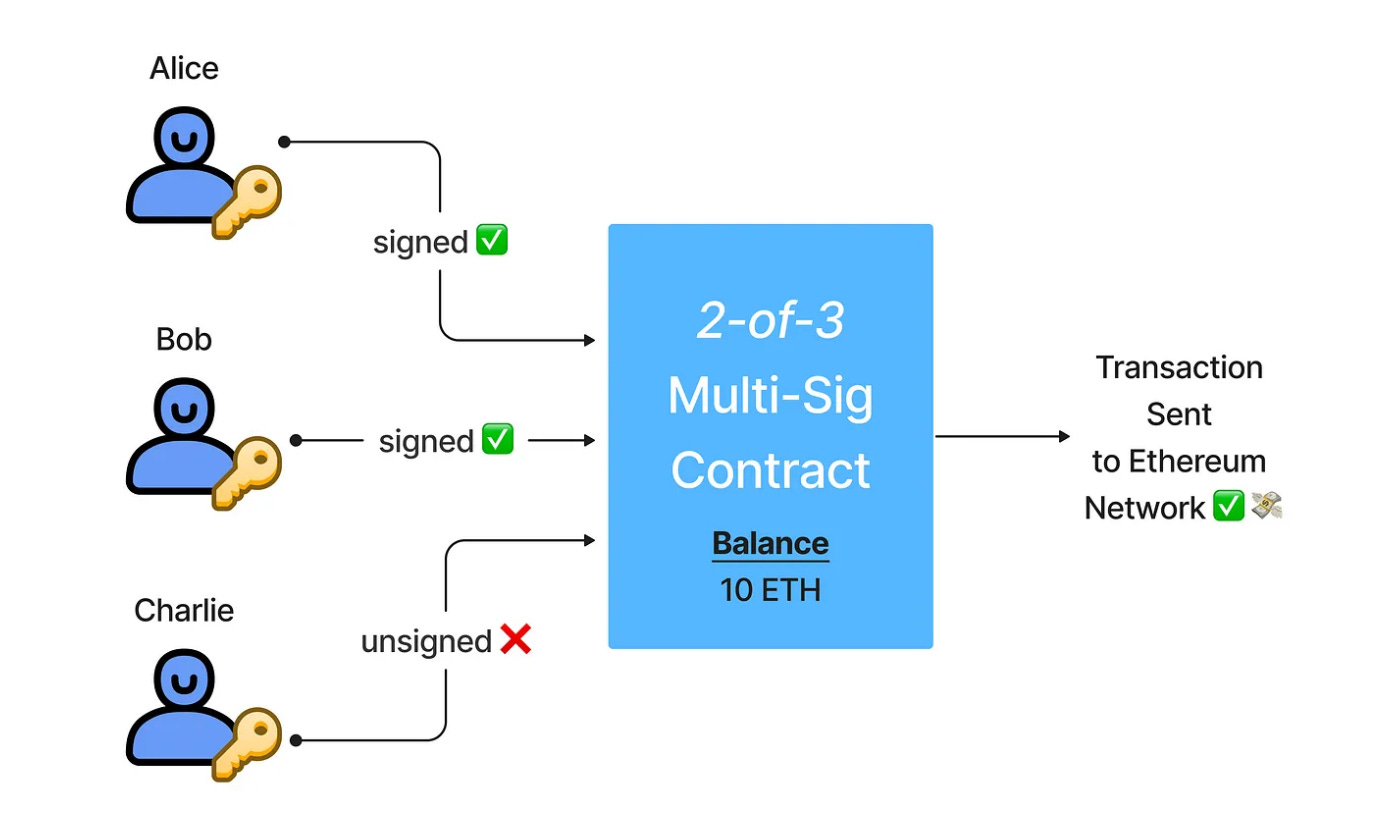

More advanced users should consider using a Safe smart account. Safe uses a multi-sig (short for multi-signature) configuration to secure your crypto. In practice, you need multiple wallet accounts to approve (sign) each transaction before it executes onchain.

The diagram above shows a 2/3 multi-sig smart account with three individuals. Two approvals are required to execute each transaction. In the example above, Alice and Bob approved (signed) the transaction, so it executes.

You can set up your own 2/3 multi-sig in which you control all of the wallet accounts, ideally using three different hardware wallets. Each transaction would require approval using two separate hardware wallets.

It sounds complex, but it’s quite straightforward and dramatically improves security. Consider a corporate bank account where two people, e.g., the CEO and CFO, must approve large expenditures. A crypto multi-sig is similar.

With a Safe smart account and a 2/3 configuration, a hacker must simultaneously compromise two of your hardware wallets to access your funds—a very high hurdle.

Digital Property Rights

Onchain self-custody is the foundation for financial freedom. However, Crypto is more than just finance.

Decentralized blockchain applications bring greater freedom, privacy, and censorship resistance to many other areas. Government overreach, after all, is not just limited to finance.

Identity. Ethereum brings digital property rights to identity management primarily through self-sovereign, cryptographic ownership of onchain identifiers. ENS, for example, maps human-readable names to onchain wallet addresses. It can serve as your onchain passport, email, and website address.

Content. Onchain solutions like Fileverse allow users to publish, own, and control digital content directly onchain (or anchored to it), without relying on centralized platforms.

Communications. Messaging platforms like XMPT enable wallet-to-wallet encrypted communication. Social media platforms like Lens and Farcaster connect users while avoiding government or corporate censorship and control.

Your Financial Firewall

Crypto self-custody can safeguard your life savings during a banking crisis. It can prevent government authorities from seizing your funds without due process. It ensures corporations can’t prioritize their profits over your life savings.

Investing in crypto does not just mean Bitcoin. Stablecoins allow you to hold crypto Dollars or Euros with far less volatility.

But sovereignty comes with responsibility. Self-custody isn’t plug-and-play. It requires knowledge, patience, and practice.

Crypto has real use cases: decentralized finance, identity management, content creation, communications, and more. It starts with proper self-custody, the foundation for everything onchain.