Why So Many Tokens?

A framework for classifying cryptocurrencies

Outsiders are often perplexed by the sheer number of crypto tokens. Why are there thousands and thousands of cryptocurrencies? Isn’t the whole point to create a new kind of money, more global currencies? And if Bitcoin already exists, what are all these other crypto coins trying to do?

This confusion is understandable. The name cryptocurrency implies that every token is trying to be a currency — a replacement for the dollar or Euro. But that’s not actually true.

In fact, most crypto tokens are not trying to be money at all!

Yes, some tokens — like Bitcoin — are explicitly designed to be digital money. But that’s the exception, not the rule. Many tokens play entirely different roles: they power infrastructure, govern applications, or simply reflect community memes. To understand why we have so many cryptocurrencies, we must look beyond Bitcoin and examine how crypto tokens are used in practice.

How to Classify Crypto Tokens

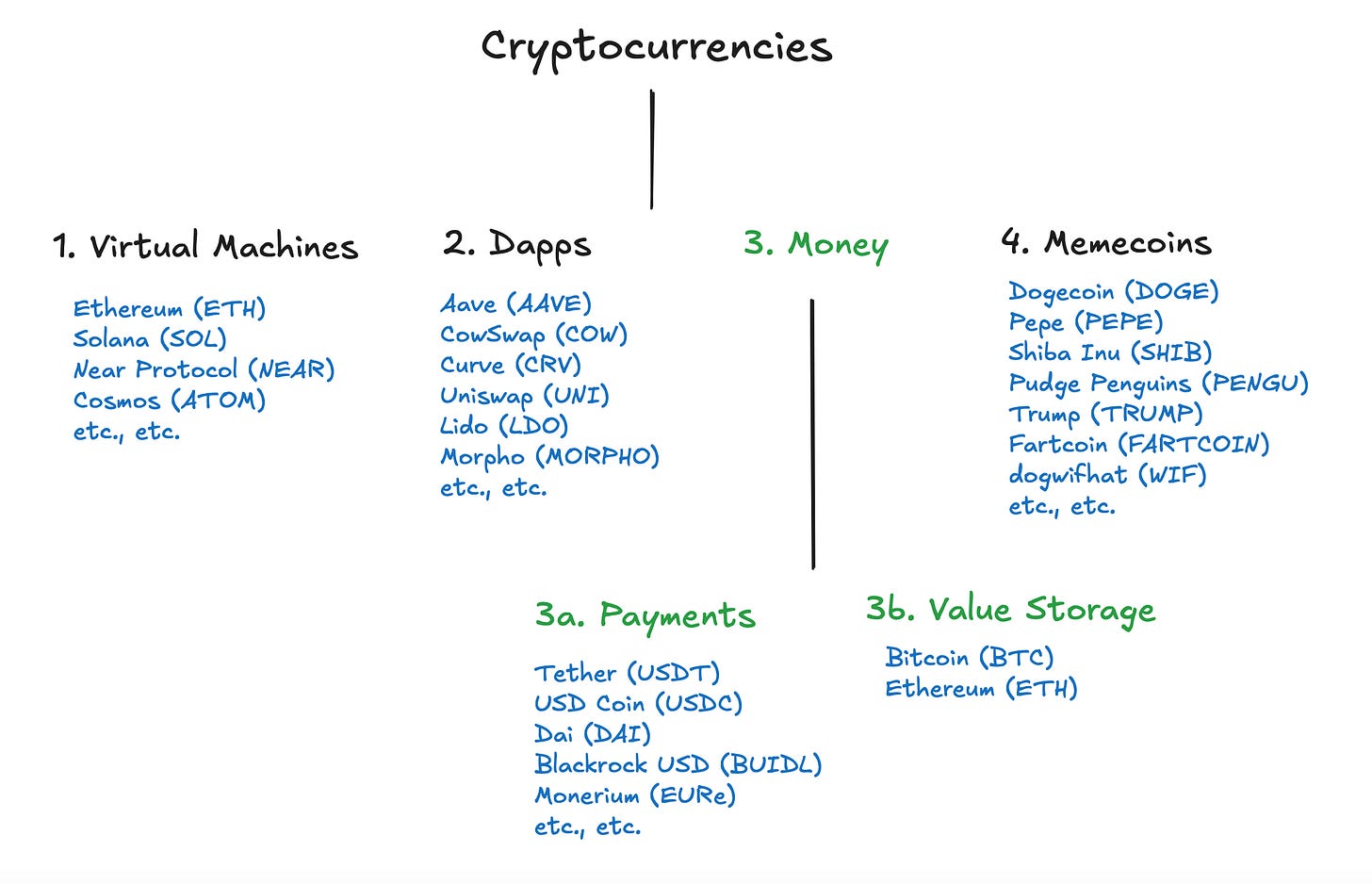

In 2017, investor John Pfeffer proposed a useful classification of crypto tokens in An (Institutional) Investor’s Take on Cryptoassets. He identified three primary categories:

Network backbone / Virtual Machine (e.g., Ethereum)

Distributed applications (Dapps)

Money, further divided into:

a. Payments

b. Monetary store of value

To his list, I’ll add a fourth category that has become increasingly important:

Memecoins

Note: this classification applies to fungible tokens. Non-fungible tokens, or NFTs, emerged later with the ERC-721 standard on Ethereum and will be covered in a future article.Let’s go through each category — and see why money is just one piece of the puzzle.

1. Network Backbone / Virtual Machine

This category is foundational but often overlooked or misunderstood. Ethereum is the flagship virtual machine, but other examples include Solana, Near Protocol, and Cosmos.

These blockchains are not currencies — they are programmable platforms. They serve as general-purpose infrastructure, enabling users to deploy smart contracts and build decentralized applications.

Think of Ethereum as an operating system, a decentralized world computer. It’s not an “app” — it’s the platform all apps run on.

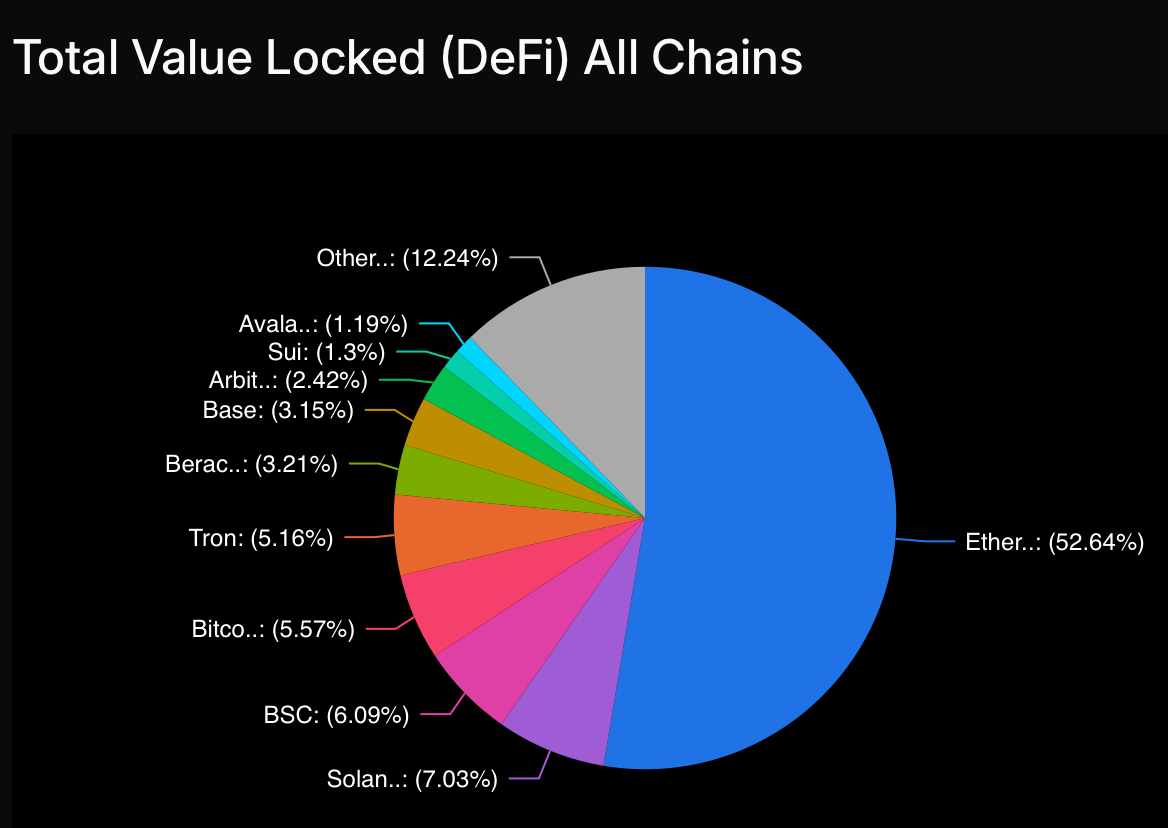

For example, over the past five years, decentralized finance (DeFi) has grown into a global industry with over 90 billion USD in onchain assets, mostly on Ethereum. Thousands of applications that power DeFi share Ethereum’s composability, interoperability, global access, trustless execution, transparency, and more.

Ethereum’s token ETH plays a critical role in powering the Ethereum Virtual Machine (EVM):

Users pay “gas” in ETH to execute transactions.

Validators stake ETH to secure the network.

The token aligns incentives and prevents spam or abuse.

The SOL token plays a similar role on Solana, the ATOM token on Cosmos, etc.

Bitcoin, by contrast, lacks the ability to run smart contracts and has limited programmability, which is why DeFi barely exists on that network today.

2. Distributed Applications (Dapps)

If base-layer chains are the operating system, dapps are the apps. They’re what most users interact with onchain: lending platforms, decentralized exchanges, prediction markets, games, and more.

A few well-known examples of apps on Ethereum or EVM chains include:

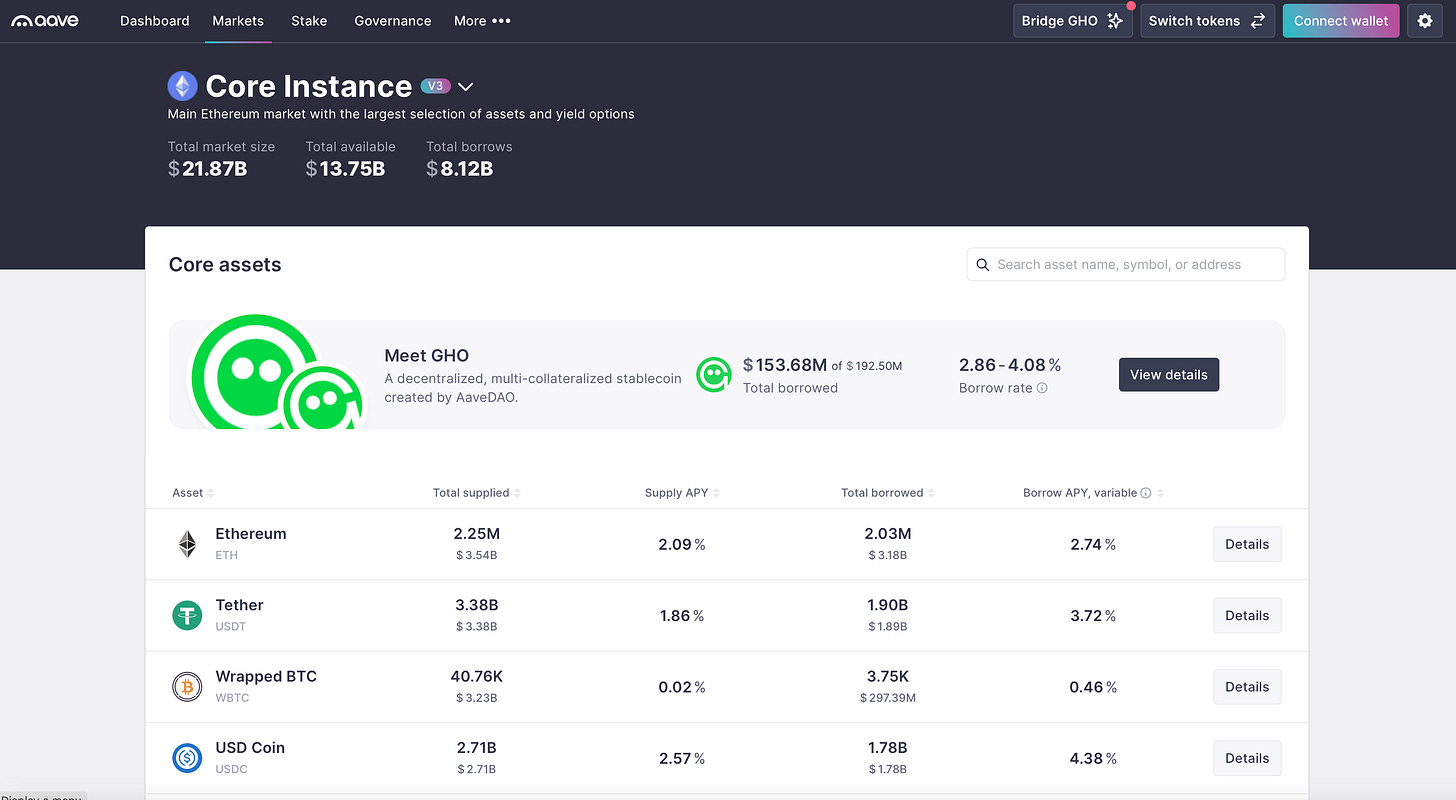

Aave. The most popular borrow/lend platform, with over 17 billion USD in deposits. Aave is a replacement for your traditional bank. Want to earn interest on your dollar stablecoins or use ETH as collateral for a dollar-denominated loan? You can do it in seconds, permissionlessly, on Aave.

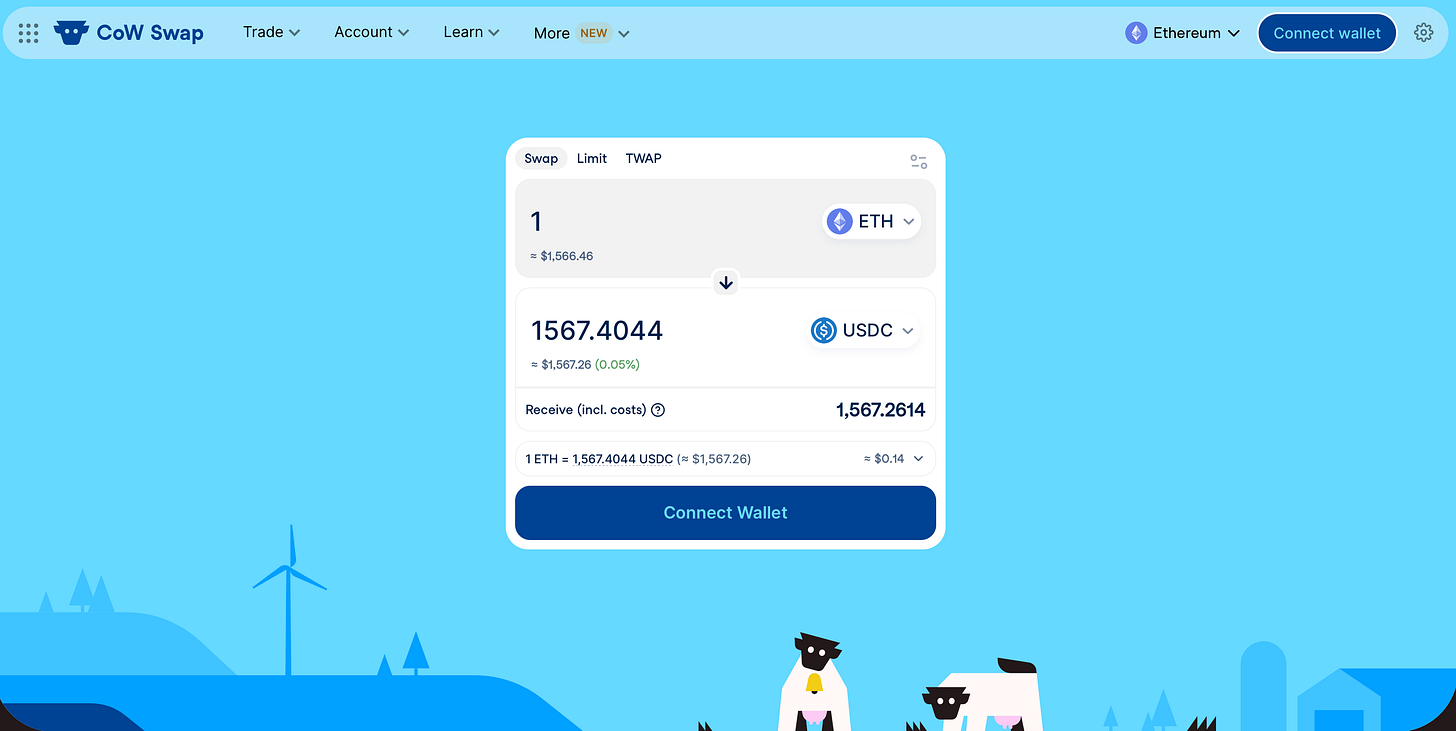

CowSwap. My go-to application to buy or sell crypto. No need to trust a centralized exchange and pay high fees. Just connect your wallet and trade.

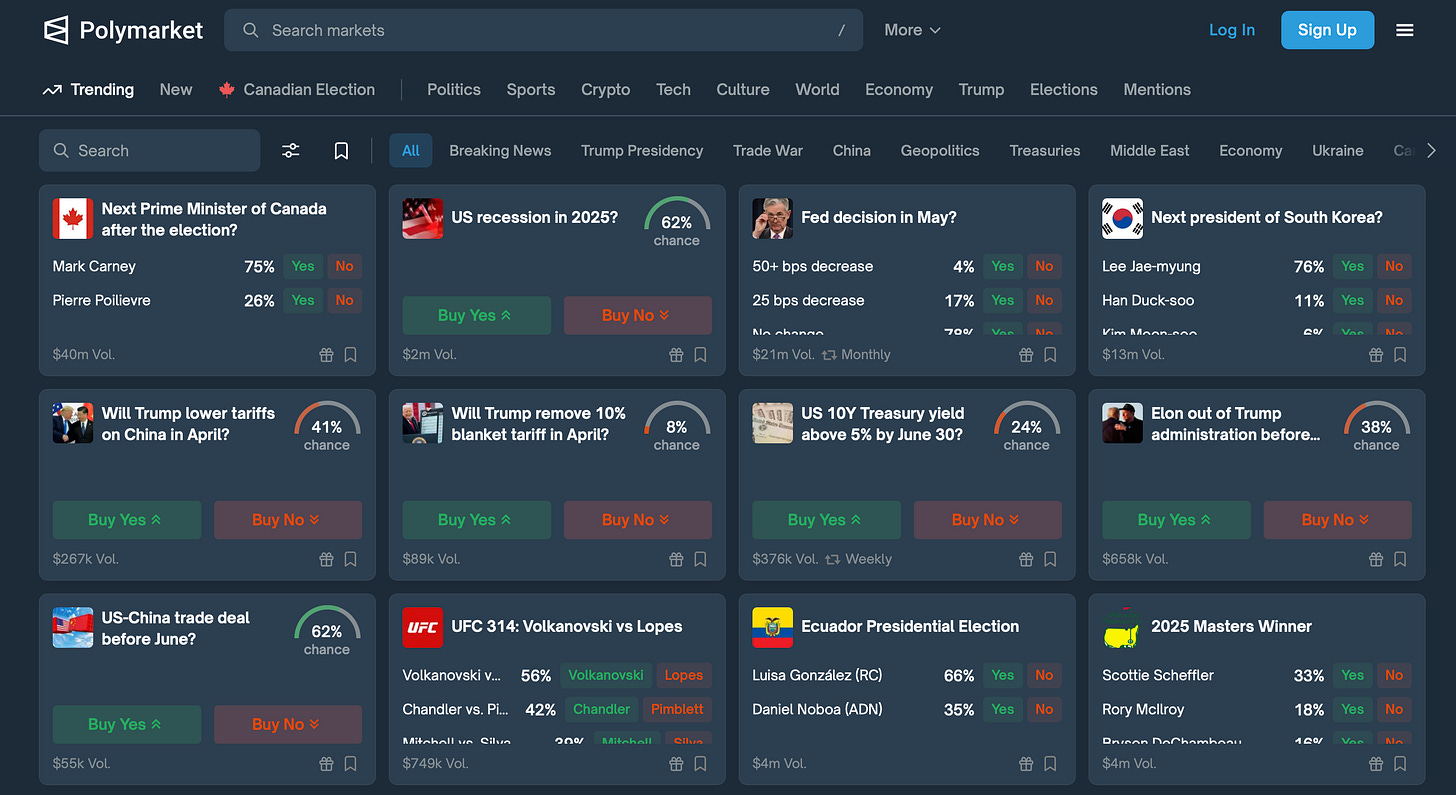

Polymarket. Polymarket is a decentralized prediction market platform built on the Polygon blockchain (EVM compatible, using the same runtime environment as Ethereum). It enables users to trade on the outcomes of real-world events, including politics, sports, economics, etc.

A dapp will often have its own native token, primarily used for:

Governance (e.g., voting on proposals)

Incentives (e.g., staking for yield)

Access (e.g., fee discounts or better loan terms)

Rewards (e.g., earned income paid to token holders)

For example, I stake my AAVE tokens in their safety module to earn additional yield, paid in AAVE. I help secure the application by assuming risk: up to 30% of my staked AAVE tokens can be used to cover shortfalls in an emergency.

Native tokens are not currencies in the traditional sense. They're utility tokens or governance tokens — more like stock options or voting shares than digital cash. Value accrues based on perceived value, often linked to future cash flows (dividends, airdrops), similar to equity in traditional finance.

Decentralized communities (DAOs) coordinate and secure a dapp’s open-source software with native tokens. Native tokens help align community interests, fund development, and keep systems running—not replace your local currency.

3. Money

Now we come to the one category where tokens are trying to be money.

Pfeffer rightly distinguished between two types of money within the crypto space:

Payments – e.g., using crypto to buy coffee or send remittances.

Monetary store of value – holding crypto as a long-term investment.

Bitcoin is the clear standout in this category. BTC aims to be both a payment platform and a store of value, but it has only partially succeeded.

✅ It’s widely held as a store of value (digital gold), especially by early adopters and institutions.

❌ But it has largely failed as a payment system: slow, expensive, and volatile.

Instead, stablecoins have emerged as the dominant tool for payments in crypto.

Stablecoins are tokens typically pegged to fiat currencies (e.g., USDC, USDT), and they now settle trillions in onchain volume. Most stablecoins exist on Ethereum, not Bitcoin.

Stablecoins have become the killer use case of crypto, although few outside of crypto are aware of their growing popularity. In 2024, the annual stablecoin transfer volume surpassed the combined volume of Visa and Mastercard by over 7.68%. Total stablecoin supply reached 1% of the total U.S. dollar supply!

Note: I manage my own business onchain, primarily with stablecoins like EURe (a EUR-denominated stablecoin) and USDC. You can read more about the applications I use to invoice clients and manage accounting here.👉 Stablecoins on public blockchains, primarily on Ethereum, are the future of global payments, not BTC.

There are now hundreds of stablecoins, although just two—USDT (Tether) and USDC—account for 88% of the total stablecoin market cap (April 2025).

If Ethereum is so dominant as a payments platform — and as a world computer supporting thousands of decentralized apps — is the ETH token also a store of value, similar to BTC? 🤔

That will likely depend on the ultimate utility of ETH. BTC’s value comes from its first-mover advantage, its perceived rarity, and the religious fervor of its holders. Case in point:

Ethereum will need to prove, over time, that it can power a future global financial system and confirm its status as the most reliable, most used, smart contract platform for decentralized applications.

4. Memecoins

Memecoins are a class of crypto tokens that derive their value not from utility or infrastructure, but from internet culture, viral humor, and speculation. Think of Dogecoin, PEPE, TRUMP, or my personal favorite, Pudge Penguins (PENGU) — coins with little or no intrinsic value but enormous followings.

They often begin as jokes, but memecoins can grow into surprisingly valuable assets purely because enough people decide they want to own them. Most, of course, are totally worthless. In a way, they’re a reflection of market psychology: value created through collective belief, FOMO, and meme propagation.

When crypto detractors dismiss crypto as a joke, memecoins are often used as evidence to prove their point. But despite their lack of fundamentals, memecoins can serve several indirect purposes:

They act as onboarding ramps for new users to crypto.

They showcase the power of decentralized communities.

And sometimes, they raise serious questions about what gives money value in the first place.

Solana has emerged as the primary blockchain for memecoins, one of the few segments in which Ethereum is not the market leader.

Pump.Fun, a memecoin launchpad on Solana, created over 51,000 new crypto tokens in a single day in November 2024! That same month, Pump.Fun generated 93 million USD in revenue, before dropping by 95% as users’ interest and attention waned.

While they’re often dismissed as unserious, memecoins remind us that financial systems have always relied on social consensus. In crypto, that consensus just moves faster.

Mapping Crypto Tokens by Function

If we put it all together, we have the following categorization:

Virtual machines like Ethereum form the decentralized network backbone of crypto, on top of which developers are building new financial primitives. Dapps like Aave (banking) and CowSwap (trading) run on those virtual machines. Money can be used for both payments (primarily stablecoins) and long-term value storage. And finally, we have memecoins, the monetization of culture, the celebration of (virtual) uselessness.

Rethinking Crypto Tokens

Crypto often feels overwhelming from the outside — like a chaotic sea of coins all competing to be the next global currency. But that perception misses the point:

👉 Most crypto tokens are not trying to be money!

They’re not all chasing Bitcoin’s dream. Instead, as we have shown, they serve a variety of roles: powering decentralized infrastructure, governing applications, representing memes, or simulating dollars onchain.

Tokens are a primitive — a flexible, composable building block that can represent value, rules, identity, or culture. They are the fuel, equity, and sometimes the product of crypto networks.

Understanding this helps explain why there are so many of them — and why simply asking “What is this token worth?” is less useful than asking “What is this token for?”

The answer is rarely “to replace the dollar as a global currency.”